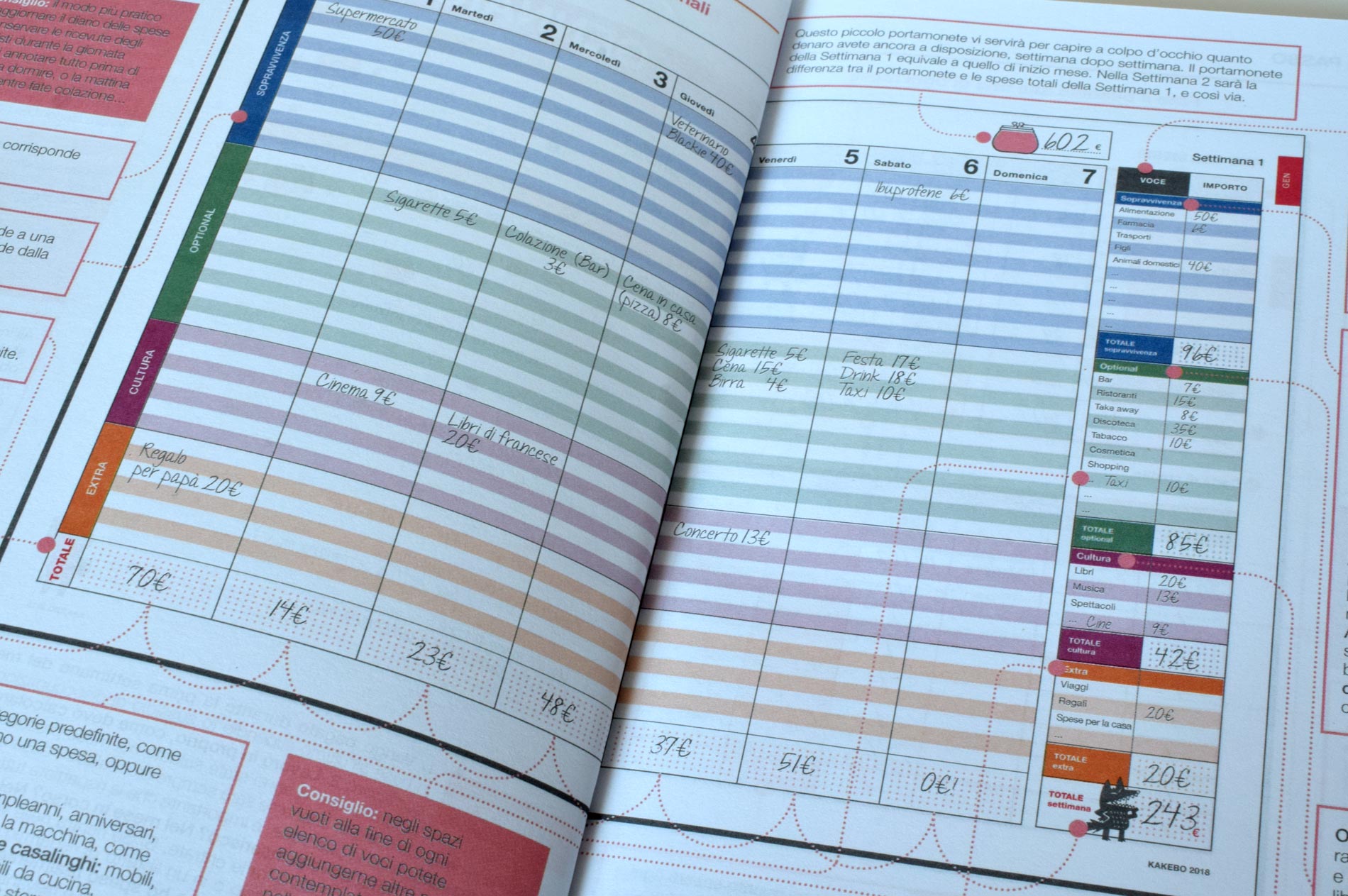

b.) Culture and education – Courses, Training, museum tickets, etc c.) Entertainment d.) OthersĤ.) You try to stay on budget within the month and at the end of the month, you do a review of your journal and see where the leakages are coming from. Grocery shopping, Uber fares, etc.ģ.) You divide your expenses into four major parts: a.) Expenses on living – food, living, rent, etc. You carry your small journal everywhere you go and use it to record your expenses in real time. You can also buy the Kakeibo journal – even better!Ģ.) Every month in your big journal, you write your planned income and expenses and you also write down your savings. jessica ufuoma The Kakeibo is both practical and actionableġ.) You’ll need these two things: 1.) A big journal you can keep at home and 2.) A small journal you can carry along with you. I love that Kakeibo focuses on mindful spending and makes budgeting more of a meditative process. It’s a more meditative way to go about things and it helps you be more aware of your spending habits. There’s something more intentional about putting pen to paper and recording things – in this case, recording your expenses and income. I also love the fact that there are no spreadsheets or apps involved. No technology, just plain old pen and paper And hey, thinking about spending money is far more fun than thinking about saving money. If you know how much money you are going to spend every month, then you can work out what you want to save. Saving money is great but I love how Kakeibo focuses on spending money. You’re required to list out all your expenses and income and focus on saving money. jessica ufuoma What I love about Kakeibo The simplicity of it The power of the Kakeibo lies in its journaling process. I didn’t ditch my spreadsheets or budgeting apps but I embraced journaling my money and it worked for me. I find it to be a better way to understand your money vs.

The thoughtfulness required to journal your habits every month and truly understand where your money is going to, really helps. What sets Kakeibo apart in my eyes is the reflection piece of it. The Kakeibo works based on four main questions: You may be wondering – what’s so special about the Kakeibo anyway? Isn’t it like any other budgeting method? Well, I thought so too until I tried it. I just wanted a simple way to get the job done. I was tired of boring spreadsheets and all the numerous apps I had. Secondly and most importantly, I wanted to save more money in a simple yet effective way. I first heard about it when I traveled to Japan and wondered if it really worked. Why I tried the Kakeiboįirstly, I tried it as a social experiment. Journaling your way into better finances and reaching your financial goals. The centre stage of this budgeting method is journaling.

I love that Kakeibo was invented by a woman and I hear it gave women freedom to make financial decisions in Japan. It was first invented by a Japanese woman called Hani Motoko. Kakeibo simply means household financial ledger. I tried it out sometime last year and I’d like to say that so far, it has worked really well for me and has brought my savings up by 40%. We all know about Marie Kondo and the art of tidying up but what about Kakeibo? Kakeibo is a budgeting system that was created by a Japanese woman and has become very popular ever since then. Ever since my trip there in 2018, I’ve been partly obsessed with the way of life of the Japanese and I’ve been applying some of their principles to my personal life. A seven-day solo trip to Japan was all I needed to be convinced of one thing: the Japanese know exactly what they are doing.

0 kommentar(er)

0 kommentar(er)